I don't support the whole "Friends of Coal" movement. I really don't care about coal, but I do care about hard working men and women who rely on coal jobs. I worry about regions that rely heavily on the coal industry for jobs. I worry how those regions will adapt to inevitable changes in the energy industry.

Leading up to the recent presidential election, I saw lots of vitriol directed at Obama regarding coal. I saw posts on facebook that Obama was bad for coal and that he hated coal miners (see examples below).

Given the mixed feelings that I have, I decided to do a little mining of my own to see if Obama really has been as bad for coal as his opponents have claimed. I reviewed the Annual Coal Report from the U.S. Energy Information Administration for 2009, 2010, and 2011. I wanted to see what has happened to coal mines, production, and jobs since Obama took office. I also looked at data from the U.S. Bureau of Labor Statistics for trends in wages in the coal industry.

As you can see in the graph below, both coal production and the number of operating mines have decreased since Obama took office. However, mining jobs have actually increased both nationally and in the Appalachian region. Eastern Kentucky, though, has seen significant decreases in mining jobs, as well as more drastic reductions in productions and mining operations.

| ||||||||||||

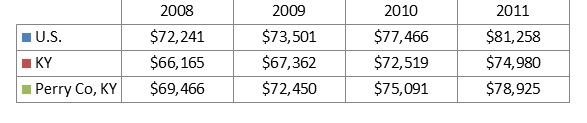

Finally, the graph below shows changes in average annual salaries in the coal mining industry since Obama took office. Here, I have presented averages for the nation, for the entire state, and for a selected county in eastern Kentucky. I chose Perry County because of it's rich coal history and because that's where my father worked in the mines. Unlike other trends, Kentucky and Perry County saw greater than average increases in wages since Obama took office. However, mining wages in Kentucky and Perry County still lag behind the national average.

Based on the actual numbers, I don't think anyone can honestly claim that Obama has wreaked havoc on miners. Despite decreases in productivity and mining operations, the number of miners in the U.S. has actually increased since Obama was first elected. I think the real question for both our government leaders and for coal companies is this: Why has eastern Kentucky suffered more decreases in coal production and employment than Appalachia and the nation?

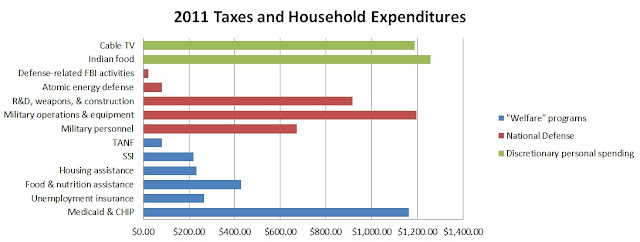

I can't help but wonder if the data in the graph below has something to do with eastern Kentucky's negative mining trend.